Partnership Account I SS3 Book Keeping Lesson Note

Download Lesson NoteTopic: Partnership Account I

SPECIFIC OBJECTIVES: At the end of the lesson, pupils should be able to

- Define partnership account

- Explain the terminologies used

- Discuss partner’s capital account

INSTRUCTIONAL TECHNIQUES:

- Identification,

- explanation,

- questions and answers,

- demonstration,

- videos from source

INSTRUCTIONAL MATERIALS:

- Videos,

- Loudspeaker,

- textbook,

- pictures

NOTE

PARTNERSHIP ACCOUNT

Introduction to Partnership Accounting

Most students need to know all about the introduction to partnership accounting which is a part of their syllabus to score good marks in the exams. These notes here are going to help them do that. A partnership can be defined as the time when two or more parties come together to run a particular business to earn some profit. These people or partners would have a share of the profits and that too in a particular ratio which is decided beforehand. In that case, the business might require some sort of special treatment of accounting. These are some things that students will get to know in the Partnership Final Accounts Introduction.

What is a Partnership?

There are many cases where businesses with a single proprietor often tend to face some sort of issues such as lesser access to some resources or limited capital. In such cases, most people tend to enter into certain partnerships so as to overcome the challenges of the business. These partnerships would allow the people to collectively share all the resources that they have and it further helps in the expansion of a business too. So, we are going to discuss all the final accounts of partnership firm introductions right now.

Some Features of Partnership

A few features Of Partnership in the introduction to partnership Class 12 chapter, there are some features that students will come across. Here are some of the features that have been explained in detail for proper understanding.

- Agreement

For the partnership to function properly, there must be some sort of agreement between the parties or the partners. This includes the sharing of profits and working collectively. The partners are responsible for drawing such agreements in writing or orally. The basic function of the agreement is to ensure that all the partners are familiar with their status and functions.

- Business

One of the most important features of a particular partnership would have to be the business. According to the Partnership Act, it is not possible to have an agreement in case the partners carry out functions as charitable activities. Businesses could be professions, trades, or some sort of occupation.

- Profit-Sharing

Another main aspect that students will get to learn in the Introduction to Partnership Final Accounts is the term profit sharing. The partners must have a share of the profits that are produced by the firm. In case someone is working for the company and not having a share of the profits, he/she may be called an employee.

- Principal-Agency Relationship

In the Chapter 1 Partnership Class 12 notes, there is a mention of the term principal agency relationship. In this case, the business of the partnership might be conducted by either all the partners or just one partner who is working on behalf of all the others. This is known as the Principal Agency. Students really need to gather more information on these topics in order to have as much idea as they can about the chapter. This might help them out in the exams.

What is a Partnership Deed?

To understand more about the introduction to Partnership Final Accounts, Students need to know what a partnership deed is. Partners are most free to determine all the terms that their relationships will have in the partnership. This can be done based on an oral or written agreement. In case the agreement is made in a written format, this is known as the partnership deed. These partnership deeds are pretty simple to understand. The agreement that the firm partners would make would further fill up the partnership deed.

In a partnership account, some of the common terminologies used include:

- Capital: The amount of money or assets that each partner has invested in the partnership.

- Drawings: The amount of money or assets that each partner withdraws from the partnership for personal use.

- Profits and losses: The financial gains and losses of the partnership as a whole.

- Distribution of profits: The allocation of profits among partners based on their ownership percentage.

- Partner’s current account: The record of transactions of each partner with the partnership, including capital contributions, drawings, and share of profits or losses.

- Partnership agreement: The legal document that outlines the terms and conditions of the partnership, including the sharing of profits and losses and the roles and responsibilities of each partner.

- Goodwill: The value of the partnership’s reputation and customer base, which is often included as an intangible asset on the balance sheet.

- Interest on capital: The amount of money paid by the partnership to each partner for the use of their invested capital.

- Reserves: The portion of profits that is set aside for future business needs or as a contingency fund.

- Dissolution: The termination of the partnership, which may occur due to retirement, death, or other reasons outlined in the partnership agreement.

PARTNERSHIP CAPITAL ACCOUNT

A partnership capital account is an account in which all the transactions between the partners and the firm are to be recorded. It maintains records of different types of transactions, which include:

- The contributions by partners to the firm. Starting from the initial contribution to the subsequent ones, each and every transaction detail is recorded. The partners can either make contributions in the form of cash or market value of the assets.

- The account also records the profits made and losses incurred by the business. It determines the allocation of the same based on the specified proportions of the partners based on the partnership agreement.

- Lastly, the account also clears the picture, indicating the distributions to be made to the partners based on their shares.

With the preparation of the partnership capital account, it becomes easy to distribute the assets and liabilities to the partners and becomes easy to settle the account at the time of admission or retirement of partners. But in the case of a partnership other than a limited liability partnership, the capital account becomes useless as the partners have to pay from the personal estate in case assets are less than liabilities, and the capital account cannot be enforced for limitation of liability. Moreover, the basis of the partnership can be changed with transactions like salary and interest to partners, which can sometimes create conflicts between the partners.

A business entity in which two or more persons doing business together agree to share the profits arising from business in the pre-defined profit ratio as partners is called the partnership firm. The partnership agreement can be oral as well as written. The profit-sharing can also be based on capital contribution or mutually decided.

The accounts of the partnership firm differ from that of the proprietorship. It also contains the partners’ capital account in which the capital contributed by partners and all the transactions between the firm and partners are to be recorded. The partner’s capital account can be of two types, i.e., current and fixed capital. If the account is a fixed capital account, then the only capital contribution is to be credited, and all other transactions are to be recorded in the current account.

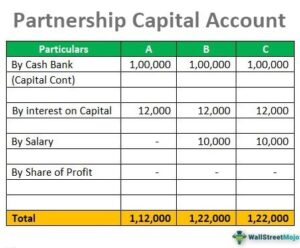

Format

The standard partnership capital account format to show how the details of transactions and contributions are recorded is presented below:

How to Calculate?

Usually, the capital contribution depends upon the share of profits if the business of a partnership firm requires an investment of $ 1,000,000 and there are four partners in the partnership firm and the profit sharing ratio is equal then each partner’s contribution will be $ 250,000 ($ 1,000,000 /4) whereas if the profit sharing ratio is 2:5:1:2 then the capital contribution of partner A will be $ 200,000 ($ 1,000,000 * 2/10), partner B will be $ 500,000 ($ 1,000,000 * 5/10), partner C will be $ 100,000 ($ 1,000,000 * 1/10) and partner D will be $ 200,000 ($ 1,000,000 * 2/10).

By mutual decision, Partners can contribute more or less, which may not be as per the profit sharing ratio, and sometimes, in partnership, one should contribute the capital. Others will invest the time and talent.

The steps for calculating the partnership capital account are as under:

- Step #1 – Credit the capital account with the capital contributed by partners, the share of profit, remuneration of partners, interest on capital, and any receipt or asset directly associated with the partner.

- Step #2 – Debit the capital account by drawings, any liability directly related to the partner, etc.

- Step #3 – A share of profit is distributed in the profit-sharing ratio before calculating closing capital.

- Step #4 – Closing capital is calculated by reducing the debits from the credits to calculate the effective capital contribution.

- Step #5 – The closing capital is transferred to the balance sheet as a partner capital account.

Advantages

A partnership capital account is quite useful as it makes it easy for the partnership firms to keep track of the contributions of each partner and their share of income by the same. The clarity that these accounts provide makes them one of the most significant records for the firms to maintain.

Let us have a look at the benefits offered by these accounts to partners in a partnership firm:

- Transparency in the records is maintained through the capital account of partners.

- In the event of the closure of a business, the amount to be received or distributed to each partner can be easily determined.

- The liabilities of each partner can be easily fixed.

- Decisions can be easily taken to maximise the benefit to the firm because of transparent records.

- A partnership capital account can be presented and accepted as a legal document.

- With the transparency and clarity of accounts, it is easy to admit the new partner, or it gets easy to settle the account at the time of retirement of a partner.

Disadvantages

Despite multiple advantages of these accounts, there are a few limitations that cannot be ignored. The individuals involved in recording the details in the partnership capital account must be aware of the demerits of maintaining such accounts.

Listed below are the limitations of this account. Let us have a look at them:

- In the case of a partnership other than a limited liability partnership, the partners are jointly and severally responsible for the outside liabilities; hence the risk of one partner is transferred to other ones in their profit-sharing ratio and from the personal estate if liabilities are more than assets and the partners capital account becomes of no value in this case as the capital account cannot be enforced for limited liability.

- As in most organisations, no separate current account is prepared; hence the basis of capital contribution gets changed with transactions.

- There are chances of conflict in case of a change in the basis of the capital.

EVALUATION:

- Define partnership account

- Explain some terminologies used

- Discuss partnership capital account

CLASSWORK: As in evaluation

CONCLUSION: The teacher commends the students positively