Joint Venture Account SS3 Book Keeping Lesson Note

Download Lesson NoteTopic: Joint Venture Account

SPECIFIC OBJECTIVES: At the end of the lesson, pupils should be able to

- Describe the format of the joint venture account

- Solve some exercises on the joint venture account

INSTRUCTIONAL TECHNIQUES:

- Identification,

- explanation,

- questions and answers,

- demonstration,

- videos from source

INSTRUCTIONAL MATERIALS:

- Videos,

- loudspeaker,

- textbook,

- pictures

NOTE

JOINT VENTURES ACCOUNT

Ali of Lahore and Bilal of Karachi entered into a joint venture for the sale of a consignment of goods in March 2018, profit and losses to be shared equally. Ali paid Rs. 10,000 for goods purchases and consigned to Bilal for Sale. He paid Rs. 400 for freight, Rs. 350 for brokerage and Rs. 100 for sundry expenses. Bilal received these goods and paid Rs. 600 for octri, Rs. 200 for the warehouse and Rs. 90 for insurance. He sold the whole consignment for Rs. 16,000.

You are required to pass general entries, joint venture accounts and prepare co-venturers accounts.

SOLUTION

EXAMPLE 2

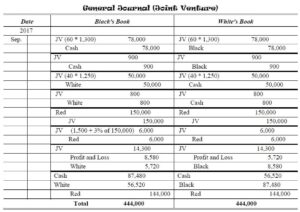

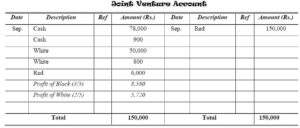

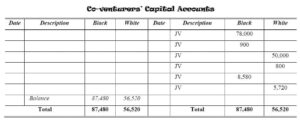

Black and White entered into a joint venture to consign 100 bales of cotton pieces and hired a commission agent Red to be sold later on the joint risk of Black and White, sharing in proportion of 3/5 and 2/5 respectively in September 2017. Black sends 60 bales at Rs. 1,300 each and pays for freight and other charges of Rs. 900. White sends 40 bales at Rs. 1,250 each and pays for freight and other charges Rs. 800. All the bales are sold by the broker for Rs. 150,000 out of which deducted Rs. 1,500 for his expenses and his commission at 3 per cent and balance remitted to consignors.

You are required to pass general entries, joint venture accounts and prepare co-venturers accounts.

SOLUTION

EVALUATION:

- X and Y entered into a joint venture to ship goods abroad in July 2018. X sends goods to the value of $ 15,000, pays freight of $ 1,500 and sundry expenses of $ 575. Y sends goods valued at $ 10,750, pays freight and insurance at $ 1,200 and sundry expenses at $ 750. Y advances to X $ 6,000 on account of a joint venture. X receives account sales and remittance of net proceeds for the whole amount of amounting to $ 37,500.

Required: Show how transactions would appear in the book of X and Y respectively, assuming a final settlement is made between them.

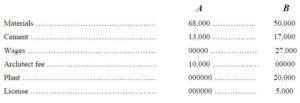

- A and B entered into a joint venture to take a building contract which was worth Rs. 240,000. They provide the following information regarding the expenses incurred by them.

The plant was valued at Rs. 10,000 at the end of the contract and A agreed to take it at that value. The contract amount of Rs. 240,000 was received by B. Pass necessary journal entries in the book of A and B and prepare joint venture and co-ventures accounts assuming 1/4th and 3/4th profit sharing ratio.

CLASSWORK: As in evaluation

CONCLUSION: The teacher commends the students positively