Principles Of Double Entry SS1 Book Keeping Lesson Note

Download Lesson NoteTopic: Principles Of Double Entry

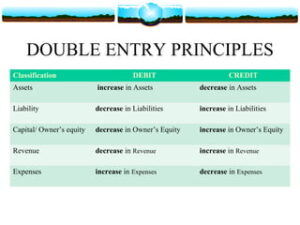

The principle states that for every debit entry, there must be a corresponding credit entry and

vice versa. It is the foundation of bookkeeping. The principle operates on the basis that every financial transaction must have two aspects i.e.:

Debit: Receiver’s account

Credit: Giver‘s account

Double entry is the act of recording business transactions twice in the books of account.

BENEFITS OF DOUBLE ENTRY

- It provides complete records of business transactions.

- It reduces the risk of fraud and facilitates the correction of errors.

- It provides a basis for the test of arithmetical accuracy of the accounting records.

- It is a means of providing financial information that may be the product of the accounting process.

- Double entry aids the effective implementation and review of the internal control system of any organization.

ILLUSTRATION ON THE PRINCIPLE OF DOUBLE ENTRY

- Jan 1 Mr Chidera started the business with N10,000

Effect

Increase in capital: Capital account

Increase in asset: Cash account

Action required: Dr Cash account-Receiver

Cr Capital account -Giver

- Jan 2 Paid N450 cash for rent

Effect

Increase in expenditure: Rent account

Decrease in asset: Cash account

Action required: Dr Rent account-Receiver

Cr Cash account-Giver

- Jan 3 bought office equipment N600, 000 by cheque

Effect

Increase in asset: Office Equipment account

Decrease in asset: Bank account

Action required: Dr Office Equipment account-Receiver

Cr Bank account-Giver

- Jan 8 Withdrew cheque for private use N2000

Effect

Increase in Drawings: Drawings account

Decrease in asset: Bank account

Action required: Dr Drawings account-Receiver

Cr Bank account-Giver

- Jan 9 Withdrew N600 cash from the bank for office use

Effect

Increase in asset: Cash account

Decrease in asset: Bank account

Action required: Dr Cash account-Receiver

Cr Bank account-Giver

- Jan 10 Received loan of N20,000 cash from Chinaza

Effect

Increase in asset: Cash account

Increase in liability: Loan account

Action required: Dr Cash account-Receiver

Cr loan account-Giver