Double Column Cash Book SS1 Book Keeping Lesson Note

Download Lesson NoteTopic: Double Column Cash Book

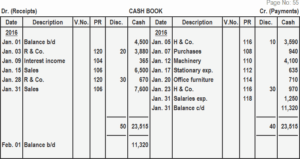

As a business grows, the owner will realize the need to open a bank account where the business money can be kept. The business will therefore prepare a two-column (or double-column) Cash Book to record the movements of money. The Cash Account and the Bank Account will appear side-by-side in the Cash Book.

The rules of double-entry bookkeeping are still applied. Any money received is debited in the Cash Book. If the money is placed in the cash till, it will be entered in the cash column and if it is paid into the bank or received as a cheque, it will be entered in the bank column.

Any money paid out is credited to the Cash Book. If the money is paid in cash it will be entered in the cash column and if it is paid by cheque, it will be entered in the bank column.

The Cash Account and the Bank Accounts must be balanced separately at appropriate intervals to determine the Cash in Hand and the Cash at the Bank.