Source Documents SS1 Book Keeping Lesson Note

Download Lesson NoteTopic: Source Documents

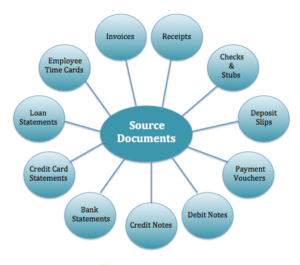

Source documents are the instruments that are generated when businesses enter into business transactions with others.

They are the written evidence of business transactions that describe the essential facts of those transactions. They are used in preparing the books of accounts.

Every business transaction whether cash transaction or credit transaction must be supported (or evidenced) by a source document. The source documents are the original documents on which information about the transactions is recorded.

It follows therefore that accounting records can only be verified when the appropriate source documents are available to do so.

EXAMPLES OF SOURCE DOCUMENTS

- Receipt

- Invoices

- Cheque (or Cheque stub)

- Bank paying – in – slip

- Debit note

- Credit note

- Statement of Account

- Vouchers

- Receipt: This is a written document issued by one person to another, to acknowledge that money or valuable property has been received. When goods are sold for cash, the customer is usually provided with a receipt.

- Invoice: An invoice is a business document prepared when goods are sold. It is normally sent by the seller of the goods to the buyer. When a business sells goods on credit, it will issue an invoice to the purchaser. To the seller of the goods, the copy of the invoice is a sales invoice. The same document in the hands of the buyer of the goods is called a purchase invoice.

The invoice contains the following information:

- The name and address of the supplier.

- The name, address and the account number of the customer.

- The supplier’s invoice number.

- The customer’s order number (for goods supplied in response to an order).

- The date on which the transaction is effected.

- A detailed description of the goods clearly showing the quantity bought, unit price, total price, terms of sale, terms of payment, details of trade discounts etc.

- Cheque: A cheque is a written order made by a customer to the bank to pay a stated sum of money to the person or business named on the cheque. When cheques are issued to make payment, the cheque itself or its counterfoil (or stub) would serve as the source document for the payment.

- Bank – Paying in Slip: This is the standard form required to be filled in duplicate or triplicate whenever cash cheques, bank drafts etc. are being paid into an account maintained with the bank.

- Debit Note: This document is issued by the seller of goods to correct an undercharge made in the account of the purchaser of the goods. For example, if the amount due from the purchaser of the goods is N18,500 and the seller has mistakenly charged (or recorded) N15,800 on the invoice, it follows that the purchaser has been undercharged by N2,700. The seller will therefore issue a debit note of N2,700 to the purchaser to correct the undercharge

- Credit Note: This document is issued by the seller of the goods to correct an overcharge made in the account of the purchaser of the goods. A credit note is therefore prepared when for several reasons the amount due from the customer (to whom goods have been sold on credit) is to be reduced

The following are some of the reasons why the seller will issue a credit note to his customers:

- When a customer has been overcharged e.g. by a mistake on the sales invoice.

- The customer returns some of the goods he previously bought.

- Some allowance is to be made to the customer e.g. in respect of damaged goods retained by the customers.

- Statement of Account: This is the summary of the transactions between the seller and his credit customers. It is issued by the seller and sent to the customers at regular intervals (usually at the end of each month).

- Vouchers: These are source documents used for obtaining authorization for all payments whether by cash, cheque or letters of authority.

USES OF SOURCE DOCUMENT

- They are used in the preparation of accounting books.

- They provide written evidence of the business transactions that have taken place.

- They can serve as proof of ownership of property e.g. receipt.

- They are used for audit purposes.

- They are used for the reconciliation of accounts.

- They are used to obtain authorization for payments made e.g. vouchers.

- They are used to correct an overcharge or undercharge made in the customer’s account.