Single Column Cash Book SS1 Book Keeping Lesson Note

Download Lesson NoteTopic: Single Column Cash Book

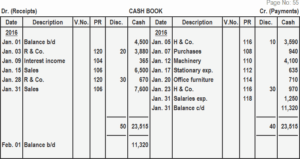

A single-column cash book is the simplest form of Cash Book operated by a business and it is used to record all cash transactions. The cash transactions recorded in the cash book can be for cash sales, cash purchases, payment of cash to suppliers, receipt of cash from customers, acquisition of properties (fixed assets) by cash and all other transactions that involve the receipt and payment of cash.

Illustration:

Prepare a Cash Book from the following information for March 2017

| Date | Description | Amount |

| Mar 1 | Balance of cash in hand | 14,130 |

| Mar 2 | Received Cash from Adesola a credit customer | 3,600 |

| Mar 4 | Paid rent for the month | 1,750 |

| Mar 5 | Paid cash to Lawal, a supplier | 3,200 |

| Mar 9 | Cash Sales | 15,235 |

| Mar 12 | Received from D. Bright as a loan | 10,000 |

| Mar 18 | Paid Ayodele a supplier | 6,250 |

| Mar 19 | Received Cash from Bonik Ventures | 14,000 |

| Mar 22 | Credit Sales to Owoyemi | 42,000 |

| Mar 24 | Purchases on Credit from F. Lawal | 15,550 |

| Mar 26 | Paid wages to shop clerk | 4,500 |

| Mar 28 | Paid Electricity Bills | 1,200 |

| Mar 30 | Paid carriage on purpose | 2,550 |

Cash Book

| Date | Narration | Folio | Amount | Date | Narration | Folio | Amount |

| 2017 | N | 2017 | N | ||||

| Mar 1 | Balance | b/d | 14,130 | Mar 4 | Rent | 1,750 | |

| Mar 2 | Adesola | b/d | 3,600 | Mar 5 | F. Lawal | 3,200 | |

| Mar 9 | Sales | 22,100 | Mar 10 | Purchase | 15,325 | ||

| Mar 12 | D. Bright –

Loan |

10,000 | Mar 18 | Ayodele | 6,250 | ||

| Mar 19 | Bonik Ventures | 14,000 | Mar 26 | Wages | 4,500 | ||

| Mar 28 | Electricity | 1,200 | |||||

| Mar 30 | Carriage inwards | 2,500 | |||||

| Mar 31 | Balance | c/d | 29,205 | ||||

| 63,840 | 63,840 |

Note: The credit sale of March 22 and credit purchases of March 24 are not posted to the cash book because they do not involve the movement of cash. The two transactions can only be posted in the Sales Journal and the Purchases Journal respectively. Students should watch out for transactions like these during examinations.