Control Account SS2 Book Keeping Lesson Note

Download Lesson NoteTopic: Control Account

A control account is an account which records in total what has been entered in detail in the ledger account to which it relates.

It can also be defined as a special account put in place to reflect the aggregate balances of many related subsidiary accounts that are part of the double-entry system. It is a mere memorandum account only. It does not form part of the double-entry system of accounting.

Control accounts can be kept for the following ledgers:

Sales ledger —– customers

Bought/purchases ledger – suppliers

Inventory ledger ——– stocks

Fixed assets ledger control —fixed assets

USES OF CONTROL ACCOUNT

- Location of errors

- Prevention of fraud

- Aids management control

- Internal check on ledgers clerk

- Easy detection of missing figures

- Ascertainment of debtors and creditors balances

- Preparation of information final account

- Saves time

- Grouping of account

CLASSIFICATION OF CONTROL ACCOUNT

- Sales ledger control account

- Purchases ledger control account

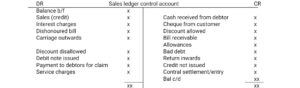

- Sales Ledger Control Account: The sales ledger control account is sometimes called a total debtors control account. It is the control account for sales or debtors’ ledger. This will represent all the entries posted to the sales ledger as if only one debtor existed.

- Purchases Ledger Control Account: The purchases ledger control account is referred to as a total creditor control account. It is the control account for purchases or creditors ledger. This will represent all the entries posted to the ledger as if only one creditor existed.

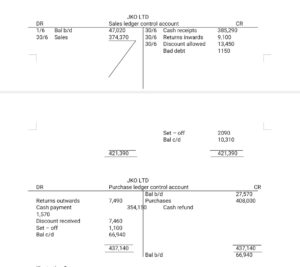

ILLUSTRATION

Extract from the books of JKO Ltd, show the following balances for June.

| Sales ledger balance – 1 June 19×3 | 47, 020 |

| Purchases ledger balance – I June 19×3 | 27, 570 |

| Purchases journal balances – 30 June 19×3 | 374, 370 |

| Purchases journal balance – 30 June 19×3 | 408,000 |

| Returns inwards | 9, 100 |

| Returns outwards | 7, 490 |

| Receipts from customers – cash | 385, 290 |

| Discount allowed | 13, 450 |

| Payment to customers | 354, 150 |

| Discount received | 7, 460 |

| Bad debt is written off | 1, 150 |

| Sales ledger set–off | 2, 090 |

| Purchases ledger set–off | 1, 100 |

On 30th June 19×3, it was discovered that a supplier was paid twice in error for N1,570. The amount was refunded on that date.

You are required to determine the sales and purchases ledger balances on 1 July 19×3.