Branch Account SS3 Financial Accounting Lesson Note

Download Lesson NoteTopic: Branch Account

SPECIFIC OBJECTIVES: At the end of the lesson, pupils should be able to

- Differentiate between departmental and branch account

- Mention and explain the types of branch

- State the importance of branch account

INSTRUCTIONAL TECHNIQUES:

- Identification,

- explanation,

- questions and answers,

- demonstration,

- videos from source

INSTRUCTIONAL MATERIALS:

- Videos,

- loudspeaker,

- textbook,

- pictures

NOTE

BRANCH ACCOUNT

A branch of an organisation whether business or non-business can be defined as a part of the organisation operating with some degree of independence. For example, a business concern may have its head office situated in one city with several branches in different parts of the country. Thus, a branch is created where a section of a business is segregated physically from the main section. In other words, if the location of activities is separated from the main place or operation, a relationship is created between the branches and the head office.

The method of accounting for branches essentially depends on the dealings and transactions between the head office and the branches. A branch may be a small retail shop managed by a single person, selling only goods sent by the head office, or it may be a foreign branch located

thousands of kilometres away from the head office, purchasing the required materials, manufacturing and distributing the products in its area, with its activities controlled only to a very small degree by the head office.

Divisions of Branches

For accounting purposes, branches may be divided into the following three classes:

- Branches for which the whole of the accounting records are kept by the head office

- Branches which maintain separate accounting records

- Foreign branches

Methods of Accounting for Branches

Where the Head Office Keeps the Accounts

This method is used basically when the branches are regarded as the sales department, receiving all goods they deal in from the head office which the branch manager must account for. In this method, the head office does all the buying and the branch only sells. The branches receive goods from the head office at selling price and the branches must as a necessity produce the cash or stock to cover the value of goods received. Managers at the branches are put on check through preparation and forwarding of reports giving the details of goods received and returned to the head office, cash sales, credit sales, cash received from debtors, stock, expenses and debtors at regular intervals.

Pricing Method

There are three different pricing methods which a head office can use to charge goods to the branches as follows:

- Cost price

- Cost plus a percentage

- Selling price

Cost Price Method

The cost price method can be used where goods are perishable or where the selling prices are difficult to determine due to fluctuations. The method charges out goods sent to the branch at cost price and the opening and closing stocks are also taken at cost price.

This method has the major disadvantage of lacking the check imposed on trading activities of the branch by the selling price method.

Cost Plus a Percentage Pricing Method

This is regarded as the most effective method of charging goods to the branch. Goods are sent to branches at cost plus a fixed percentage. The head office will keep accounts which will disclose the gross profit or loss of the branch, in a situation where cost plus a percentage at which the goods are charged is equivalent to the selling price, the head office will also have stock control. Hence the total goods received by the branch from the head office must be equal to sales plus returns to the head office plus the branch closing stock.

Under cost plus method, the head office keeps:

- Branch stock accounts.

- Goods sent to the branch account.

- Branch stock adjustment account.

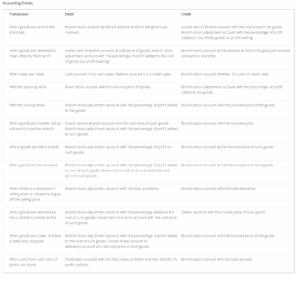

There are two methods used in recording and presenting accounting entries under the cost-plus percentage method. These are as follows:

- Branch stock adjustment method.

- Memorandum or double-column method.

Branch stock adjustment method

Using this method, the following accounts are prepared.

- Branch stock account: This account records goods sent to the branch by the head office at the involved price.

- Branch stock adjustment account: This account is used to record the amount of loading added to the cost of the goods sent to the branch. The account is used to ascertain the actual gross profit of the branch.

- Goods sent to the branch account: This account is recorded at the cost price of the goods sent.

- Debtors account: This account records transactions of the debtors.

At the end of the period, the goods sent to the branch account will be closed by transferring the balance to the head office purchases account. This transfer relieves the head office trading account to charge for these goods since they have been fully accounted for in the branch stock account and the branch stock adjustment account. The balance on the adjustment account will be transferred to the profit and loss account.

Selling Price Pricing Method

Sometimes goods are sent to the branches by the head office at selling prices, i.e. the goods are sent to branches at actual prices at which they are to be sold by the branches.

Most goods which are proprietary goods are charged and sent to branches using this method.

This method aims to provide adequate checks on the branch managers and staff to ensure that all goods sent to them are fully accounted for.

The head office would maintain the following accounts in respect of the branch:

- Branch stock account

- Goods sent to branch account

- Total debtors account

- Expenses account

At balancing time, the balance on the branch stock account represents the closing stock of the branch at selling prices.

Accounting for Branches Which Keep Separate

Account Records

At times, it is considered expedient for a branch to keep complete financial records at the branch. This may be due to:

- The branch is located far from the headquarters

- The nature of activities of the branch

- Where the size of the branch makes it economical for the account to be so prepared

To record the transactions, efforts are made to show the connection between the branch and the head office through the following accounts:

- Head office current account or head office account

- Branch current account or branch account

At any time, the branch account in the head office will show the indebtedness of the branch to the head office. The relationship between the head office and branch is that of debtor and creditor. This is evidenced by the debit balance of the branch account in the head office books, and also a corresponding credit balance of the head office account in the branch books.

The current accounts are used for all transactions that are concerned with supplying resources of the branch as well as transactions involving withdrawals of resources from the branch.

It is noteworthy to emphasise that whatever profit is earned by the branch does not belong to the branch, it should therefore be credited to the head office’s current account and any loss debited to the account ultimately, the head office will debit the branch’s current account and credit the profit and loss account.

Foreign Branches

Foreign branches occur whenever a business has parts of its trading and manufacturing activities carried out by one or more of its branches located in other countries. In such a situation separate accounting records are maintained at the branch. The branch will thus maintain separate accounting records as described earlier.

The following are the features of the foreign branch:

- The branch account in the head office books is ruled with two columns; one column is maintained in foreign currency and the other in local currency (i.e. Naira).

- The entries in the foreign currency are memoranda in nature and necessary for reconciliation with the head office account.

- The branch will forward a copy of its trading and profit and loss account, its balance sheet and a detailed copy of the head office account to the head office.

- The branch assets, liabilities and revenue items will be converted at the applicable rate between the country of the branch and the head office.

EVALUATION:

- Differentiate between branch and department

- Mention and explain the types of branch

- State the importance of the branch

CLASSWORK: As in evaluation

CONCLUSION: The teacher commends the students positively