Purchase Of Business Account SS3 Financial Accounting Lesson Note

Download Lesson NoteTopic: Purchase Of Business Account

SPECIFIC OBJECTIVES: At the end of the lesson, pupils should be able to

- Prepare journal entries and ledger

- Solve some exercises on the purchase of a business account

INSTRUCTIONAL TECHNIQUES:

- Identification,

- explanation,

- questions and answers,

- demonstration,

- videos from source

INSTRUCTIONAL MATERIALS:

- Videos,

- loudspeaker,

- Textbook,

- Pictures

NOTE

PURCHASE OF BUSINESS ACCOUNT

EXAMPLES

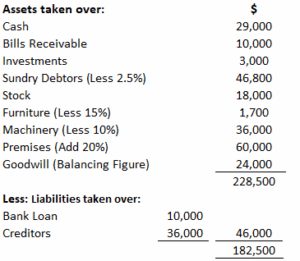

B.K. Limited, registered with a capital of $1,000,000 in equity shares of $10 each, acquired the business of John Brothers. The balance sheet of the firm at the date of acquisition was as shown below.

The assets and liabilities were subject to the following revaluation:

- Machinery and furniture to be depreciated at 10% and 15%, respectively

- Premises to be appreciated by 20%

- Make provision for bad debts on debtors at 2.5%

- Goodwill of the firm valued at $24,000

- Purchase consideration to be discharged as follows:

- Allotment of 10,000 equity shares of $10 each at $12 each

- Allotment of 500 10% debentures of $100 each at a discount of $10 each

- Balance in cash

Required: Show journal entries in the books of the company and prepare the balance sheet.

Solution

Calculation of Purchase Consideration

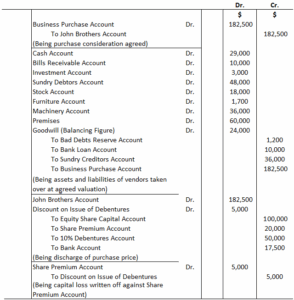

Journal Entries in the Books of B.K. Limited

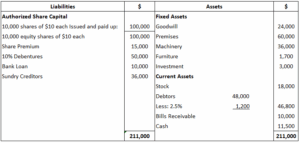

Balance Sheet of B.K Limited as on ……..

EVALUATION:

- Andrew Young agreed to take over the business of Ayo. He takes over the assets and liabilities except the cash balance.

The balance sheet of Ayo as of 31st December 1976

Andrew Young takes over the business on the following terms:

- The purchase consideration is to be ₦150,000.

- Assets to be revalued as follows; fixtures ₦60,000, motor van ₦25,000, debtors ₦13,500, and stock ₦15,000.

- The purchase price was paid on January 6, 1977.

Prepare;

Journal entries in respect of the acquisition.

Ledger entries.

Balance sheet.