Acquisition/Purchase Of Business SS3 Financial Accounting Lesson Note

Download Lesson NoteTopic: Acquisition/Purchase Of Business

SPECIFIC OBJECTIVES: At the end of the lesson, pupils should be able to

- Explain the meaning of purchase of a business

- List and explain the terminologies used in the purchase of a business account

INSTRUCTIONAL TECHNIQUES:

- Identification,

- explanation,

- questions and answers,

- demonstration,

- videos from source

INSTRUCTIONAL MATERIALS:

- Videos,

- loudspeaker,

- Textbook,

- Pictures

NOTE

PURCHASE OF BUSINESS ACCOUNT

Purchase of business is the process of acquisition of old business by a company. The person who sells the business to another company is called the vendor. The money paid by the purchaser is called the purchase price. The purchase of a business must involve an agreement between the parties.

Promoters can acquire a business and sell it to another company at a profit. A viable business is likely to sell more than its present value, whereas a business with a not-too-impressive performance may sell at a lower price

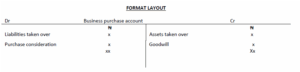

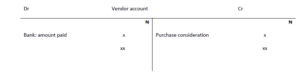

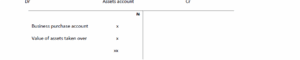

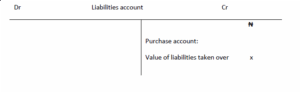

Here, assets, name, and connection of the business will be taken over hence, goodwill must be paid for. For this reason, assets and liabilities will be revalued. The purchaser can assume trade liabilities as part of the consideration. The excess of the purchase consideration over the net value of the asset is called Goodwill. If on the other hand, the purchase consideration is lower than the net assets, the purchaser has gained the advantage of “Capital reserve”. In some cases, he may acquire all the assets without cash and leave the vendor to discharge the liabilities of the business.

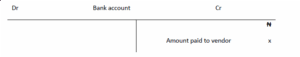

The purchase consideration can be paid in cash or shares.

TERMINOLOGIES USED IN THE PURCHASE OF BUSINESS ACCOUNT

When purchasing a business account, several terminologies are commonly used. Understanding these terminologies is important for making informed decisions when purchasing a business account. It is essential to carefully consider the costs, benefits, and potential risks of any account type and to review the terms and conditions carefully before making a purchase. Some of the most important ones include:

- Account type: This refers to the specific type of account or service that a business is offering for purchase. Examples include software subscriptions, advertising accounts, and payment processing platforms.

- Payment information: This refers to the information that a buyer provides to complete the purchase transaction. This typically includes credit card or bank account details.

- Terms and conditions: This refers to the legal agreement between the buyer and the business, outlining the terms of the purchase and any associated rights, responsibilities, and restrictions.

- Benefits: This refers to the advantages or positive outcomes that the buyer can expect to receive from purchasing the business account. Examples include increased efficiency, expanded reach, and improved profitability.

- Costs: This refers to the financial expenses associated with purchasing the business account, including any upfront fees, ongoing subscription costs, and additional expenses like advertising or training.

- Risks: This refers to the potential negative outcomes or downsides associated with purchasing the business account, such as poor performance, security vulnerabilities, or legal issues.

EVALUATION:

- Explain the meaning of purchase of account

- List and explain four terminologies used in the purchase of a business account

- What is the format/layout of the account?

CLASSWORK: As in evaluation

CONCLUSION: The teacher commends the students positively