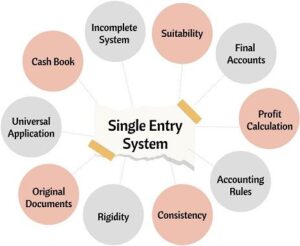

Single Entry And Incomplete Records SS2 Financial Accounting Lesson Note

Download Lesson NoteTopic: Single Entry And Incomplete Records

Most businesses keep records of receipts and payments. The records may consist of bank paying in book counterfoils, chequebook counterfoils and bank statements in addition to supplies invoices and copies of sales invoices. From these records, it may be possible to prepare a P&L A/C and Balance Sheet.

STEPS INVOLVED IN PREPARING A P&L A/C AND BALANCE SHEET FROM INCOMPLETE RECORDS;-

The necessary steps are as follows:-

Step 1: Preparing an opening statement of affairs (to obtain opening capital)

Step 2: Prepare a receipt and payments A/C

Step 3: Prepare control A/CS for debtors and creditors, if necessary to calculate sales and purchases. It is the sales and purchase figure that will be required to make the account balance.

Step 4: Adjust the receipts and payments accounts prepayments and accruals at the beginning and end of the period.

Step 5: Calculate provisions for doubtful debts, depreciation and any other matters not mentioned above.

Step 6: Prepare the P&L A/C and Balance Sheet from the information now available

CLASSWORK

The only records that Azim has kept for his business are bank pay-in-book, counterfoils, chequebook counterfoils and records of debtors and creditors. With these it is possible to summarize his transactions with the bank in the year ended 31/12/03 as follows taking paid into the bank: N8000

Cheques drawn: Payment to suppliers N2430, rent N600, electricity N320, postage and stationeries N80, purchase of shop fittings N480, cheques drawn for personal expenses N2700.

Azim banked all his taking after paying the following in cash:-

Creditor for supplies N400 and sundry expenses N115.

Azim estimated his assets and liabilities on 1st January 2003 to be: shop fittings N1600. Stock N1960, debtors N240 rent prepaid N80. Bank balance N1500, cash in hand N 50, creditors for goods N420; electricity owing N130.

On 31st December 2003 Azim listed his assets and liabilities as follows. Shop fittings N1800; stock N1520; debtors N380 rent repaired N50; bank balance N2640; cash in hand N 50; creditors for goods N390; electricity owing N225.

Required to prepare Azims profit and loss accounts for the year ended 31 December 2003 and his Balance Sheet at that date.

ASSIGNMENT

- Debtors control account reveals (a) debtors (b) creditors (c) cash received (d)sales

- In incomplete records creditors’ control account is prepared to reveal (a) sundry creditors (b) purchases (c) cash paid to creditors (d) discount received

- In adjustment accounts prepaid rent A/C should have _______ balance (a) credit (b) Debit (c) both debit and credit (d) either debit or credits

- In adjusting for final account, accrued wages should have ______ balance (a) debit (b) credit (c) debit and credit (d) debit or credit

- Calculation of provisions for doubtful debts, depreciation, etc is done in step ____ in other to prepare P&L a/c and balance sheet from incomplete records (a) 1 (b) 2 (c) 5 (d)