Receipts And Payment Accounts SS2 Financial Accounting Lesson Note

Download Lesson NoteTopic: Receipts And Payment Accounts

A receipt & payment account is a real account, which records cash transactions and events of a Not for Profit Organisation. It is a classified summary of the Cash Book maintained on a cash basis of accounting categorizing receipts and payments under appropriate heads of accounts. Receipt & Payment accounts record receipts and payments which are settled in cash of both capital and revenue nature or whether it relates to the current year, previous year or next year. It is prepared for a specific period and it is not based on the accrual system of accounting, i.e., it does not include expenses or income on an accrual basis.

All the receipts are written on the debit side, and all the payments made are written on the credit side of the account. The opening balances of this account show Cash in Hand and Cash at Bank at the beginning of the accounting period, and the closing balances of this account show Cash in Hand and Cash at Bank at the end of the accounting period. Receipt and Payment account fairly depicts the position of cash of an organization.

FEATURES OF RECEIPT AND PAYMENT ACCOUNT

- Nature: A receipt & payment account is a real account. It is a classified summary of cash receipts and cash payments.

- Basis of Recording: All the transactions and events settled in cash are recorded on a cash basis of accounting.

- Recording of Transactions: It records transactions and events of both capital and revenue nature and does not distinguish between capital receipts or payments or revenue receipts and payments.

- Period: A receipt and payment account is prepared for a specific period, i.e., for a month or a year. It includes cash and bank transactions without distinguishing among current, previous or succeeding accounting periods.

- Adjustments: Receipt & Payment accounts are not based on an accrual system of accounting, i.e., only transactions related to cash are recorded.

- Purpose: Receipt & Payment accounts are prepared to have a fair idea about the cash position of the organization. This account shows the opening and closing balances of cash in hand and cash at the bank for the accounting period.

STEPS IN THE PREPARATION OF RECEIPT AND PAYMENT ACCOUNT:

Step 1: Opening balances of the cash at the bank and cash in hand is written on the receipt side, i.e., the credit side of this account. In case, there is a bank overdraft at the beginning of the year then, it is written on the payment side, i.e., the credit side of this account to start with.

Step 2: All the transactions and events related to cash or bank which are received, i.e. receipts received in favour of the organization are written on the debit side of this account irrespective of capital or revenue nature.

Step 3: All the transactions and events related to cash or bank payments made by the organization are written on the credit side of this account, irrespective of capital or revenue nature.

Step 4: No accrued incomes or outstanding expenses are considered in this account, as they do not generate any inflow or outflow of cash.

Step 5: Now, both sides are compared and the difference that arises thereon is written as a closing balance of cash in hand, and cash at the bank on the credit side, i.e., the payment side of this account.

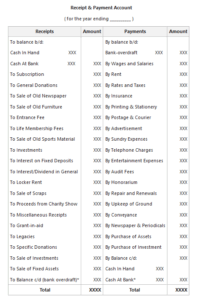

FORMAT OF RECEIPT AND PAYMENT ACCOUNT

* represents that the receipt and payment account will either have a positive or negative balance of Cash at Bank, i.e., when the receipt side is greater than the payment side, the difference is denoted as a positive balance of Cash at Bank, and when the payment side is more than the receipt side, the difference is denoted as Bank Overdraft or a negative balance of Cash at Bank.

DIFFERENCE BETWEEN RECEIPT & PAYMENT ACCOUNT AND CASH BOOK

| SN | BASIS | RECEIPTS AND PAYMENT | CASH BOOK |

| 1 | Recording | Receipt & Payments is a classified summary of Cash Book. The transactions and events which have been settled in cash are recorded. | The Cash Book records each receipt and payment. |

| 2 | Period | Receipts & Payments are prepared at the end of the accounting year. | Cash Book records the transaction daily. |

| 3 | Date | In the Receipts & Payments account, dates are not recorded. | In Cash Book transactions are recorded date-wise. |

| 4 | Ledger Folio | There is no column of Ledger Folio. | There is a separate column for Ledger Folio. |

| 5 | Entity | Receipts & Payments are prepared by a Non-Profit Organisation | Cash Book is generally prepared by any commercial organization |

| 6 | Format of Account | In the receipts & payments account, all the receipts are written on the debit side and all the payments made are | Cash Book has debit and credit sides with date, particulars, cash and bank amount columns and has ledger folio columns. |

Examples

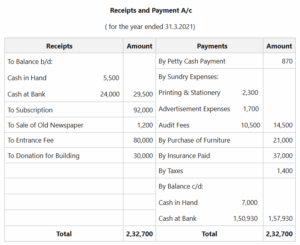

From the following information, prepare a Receipts and Payment account of Nisha Foundation for the year ended 31st March 2021:

Balance at the beginning of the year:

Cash in Hand $5,500

Cash at Bank $24,000

Subscription for the year is $92,000.

Petty Cash Payment of $870.

Sundry Expenses:

- a) Printing & Stationery expenses $2,300.

- b) Advertisement expenses $1,700.

- c) Audit fees of $10,500.

Purchase of furniture $21,000.

Sale of old newspaper $1,200.

Entrance fees received $80,000.

Donation received from Mr. Rajesh Kumar for building $30,000.

Insurance paid $37,000.

Taxes paid by the organization are $1,400.

The closing balance of Cash in Hand for the year 31st March 2021 was

$7,000. Find the closing balance of Cash at the Bank also.

Solution:

ASSIGNMENT

From the following information of GG Organisation, calculate cash at the bank at the end of the year and prepare Receipts and Payment Account for the year ending 2021-22:

Balance at the beginning of the year,1-4-2021:

Cash at Bank $43,200

Cash in Hand $17,940

Subscriptions received $6,750

Sundry payments:

Rent and Taxes $1,900

Printing and Stationery $3,160

Salaries $14,700

Sundry receipts:

Interest on Investment $5,500

Sale of Furniture $11,400

Bank Interest $800

Entrance fees received for the year 2021-22 $9,700

Balance at the end of the year,31-3-2022:

Cash at the Bank?

Cash in Hand $21,870

From the following information of GFG Club, prepare Receipts and Payment Accounts for the year ending on 31st March 2022. Cash at the Bank in the year was $1,97,300. Find Cash in Hand at the year ending:

Balance on 1st April,2021:

Cash at Bank $83,200

Cash in Hand $27,000

Subscriptions received $64,200 (including $11,100 for 2020-21 and $16,300 for 2022-23)

Special Subscriptions for Governor’s Party $49,000

Sundry Receipts:

Locker rent $31,500

Sale of Old Newspapers $1,750

Profit from Entertainment $22,800

Rent realized from Club Hall $35,500

Interest received from Investment $8,000

Sundry Payments:

Salaries $28,000 ($6,500 includes for 2020-21)

Postage and Stationery $2,020

Electricity charges $1,765

Purchase of Library Books $30,200

Expenses on Dance and Socials $1,980

Life Membership Fees are $12,630 and Entrance fees are $1,590 the club

Investments purchased by the Organisation worth $20,000

Honorarium paid by the Organisation $3,050