Partnership Accounts II – Partnership Capital Accounts & How to Calculate it SS2 Financial Accounting Lesson Note

Download Lesson NoteTopic: Partnership Accounts II – Partnership Capital Accounts & How to Calculate it

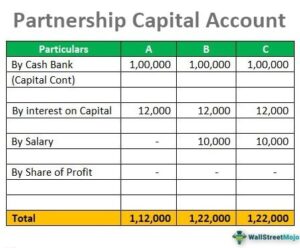

PARTNERSHIP CAPITAL ACCOUNT

A partnership capital account is an account in which all the transactions between the partners and the firm are to be recorded. It maintains records of different types of transactions, which include:

- The contributions by partners to the firm. Starting from the initial contribution to the subsequent ones, every transaction detail is recorded. The partners can either make contributions in the form of cash or market value of the assets.

- The account also records the profits made and losses incurred by the business. It determines the allocation of the same based on the specified proportions of the partners based on the partnership agreement.

- Lastly, the account also clears the picture, indicating the distributions to be made to the partners based on their shares.

With the preparation of the partnership capital account, it becomes easy to distribute the assets and liabilities to the partners and becomes easy to settle the account at the time of admission or retirement of partners. But in the case of a partnership other than a limited liability partnership, the capital account becomes useless as the partners have to pay from the personal estate in case assets are less than liabilities, and the capital account cannot be enforced for limitation of liability.

Moreover, the basis of the partnership can be changed with transactions like salary and interest to partners, which can sometimes create conflicts between the partners.

A business entity in which two or more persons doing business together agree to share the profits arising from business in the pre-defined profit ratio as partners is called a partnership firm.

The partnership agreement can be oral as well as written. The profit-sharing can also be based on capital contribution or mutually decided.

The accounts of the partnership firm differ from that of the proprietorship. It also contains the partners’ capital account in which the capital contributed by partners and all the transactions between the firm and partners are to be recorded.

The partner’s capital account can be of two types, i.e., current and fixed capital. If the account is a fixed capital account, then the only capital contribution is to be credited, and all other transactions are to be recorded in the current account.

FORMAT

The standard partnership capital account format to show how the details of transactions and contributions are recorded is presented below:

HOW TO CALCULATE?

Usually, the capital contribution depends upon the share of profits like if the business of a partnership firm requires the investment of $ 1,000,000 and there are four partners in the partnership firm and the profit sharing ratio is equal then each partner’s contribution will be $ 250,000 ($ 1,000,000 /4) whereas if the profit sharing ratio is 2:5:1:2 then the capital contribution of partner A will be $ 200,000 ($ 1,000,000 * 2/10), partner B will be $ 500,000 ($ 1,000,000 * 5/10), partner C will be $ 100,000 ($ 1,000,000 * 1/10) and partner D will be $ 200,000 ($ 1,000,000 * 2/10).

By mutual decision, partners can contribute more or less, which may not be as per the profit sharing ratio, and sometimes, in partnership, one should contribute the capital. Others will invest their time and talent.

The steps for calculating the partnership capital account are as under:

Step #1 – Credit the capital account with the capital contributed by partners, the share of profit, remuneration of partners, interest on capital, and any receipt or asset directly associated with the partner.

Step #2 – Debit the capital account by drawings, any liability directly related to the partner, etc.

Step #3 – A share of profit is distributed in the profit-sharing ratio before calculating closing capital.

Step #4 – Closing capital is calculated by reducing the debits from the credits to calculate the effective capital contribution.

Step #5 – The closing capital is transferred to the balance sheet as a partner capital account.

ADVANTAGES

- Transparency in the records is maintained through the capital account of partners.

- In the event of the closure of a business, the amount to be received or distributed to each partner can be easily determined.

- The liabilities of each partner can be easily fixed.

- Decisions can be easily taken to maximize the benefit to the firm because of transparent records.

- A partnership capital account can be presented and accepted as a legal document.

- With the transparency and clarity of accounts, it is easy to admit a new partner, or it gets easy to settle the account at the time of retirement of a partner.

DISADVANTAGES

- In the case of a partnership other than a limited liability partnership, the partners are jointly and severally responsible for the outside liabilities; hence the risk of one partner is transferred to other ones in their profit-sharing ratio and from the personal estate if liabilities are more than assets and the partners capital account becomes of no value in this case as the capital account cannot be enforced for limited liability.

- As in most organizations, no separate current account is prepared; hence the basis of capital contribution gets changed with transactions.

- There are chances of conflict in case of a change in the basis of the capital.