The Ledger SS1 Financial Accounting Lesson Note

Download Lesson NoteTopic: The Ledger

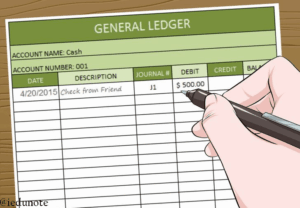

The ledger is the principal book of account which contains in a classified form, the permanent records of all the financial transactions of a business.

The recordings into the Ledger are done in classified form using ledger accounts.

FORMAT OF A LEDGER ACCOUNT

| Date | Narration | Folio | Amount | Date | Narration | Folio | Amount |

The Ledger account is divided into two sides i.e. The Debit and The Credit.

Therefore in accounting entries are described as being ‘debited’ or ‘credited’ to particular accounts. Transactions are recorded in the Ledger based on the double entry principle.

NOTE:

At the end of the month (or year or at some other convenient intervals), it is usual to balance the ledger accounts that are kept by the business. The balance of each ledger account is the difference between the two sides of the account and it represents the amount which is left in that account.

The steps necessary to balance a ledger account are summarized as follows:

- Using a calculator, add up each side of the account and find the difference between the total of the two sides.

- Enter this difference on the next available line on the side with the smaller total. Enter the date (usually the last day of the month) in the date column and the word “Balance” in the details column. It is usual to insert “c/d” in the folio column. This is the abbreviation for “carried down” and indicates where the double entry for this item will be made.

Now total each side of the account. This is done by drawing total lines and inserting the total figure between the lines. It is usual to show a single line above the total and a double line below the total. The totals of an account must be on the same level and must be the same figure.

Make the double entry for the balance carried down. On the line below the totals, write the amount of the balance on the opposite side to where the words “Balance c/d” were written. Enter the data (usually the first day of the next month) in the date column and the word “Balance” in the details column. It is usual to insert “b/d” in the folio column. This is the abbreviation for “brought down” and indicates where the double entry for this item was made

THE SUBDIVISIONS OF THE LEDGER

As a business grows, the volume of transactions increases and the number of ledger accounts required to keep the financial records increases. It will therefore be necessary to divide the ledger into different sections.

Dividing the ledger into sections makes it more convenient to use as the same type of accounts can be kept together and the task of maintaining the ledger can be divided between several people. The ledger is usually divided into the following specialized areas:

- Cash Book – i.e. the main Cash Book and the Petty Cash Book

- Sales Ledger – This is also referred to as the Debtors Ledger. All the personal accounts of debtors (credit customers) are kept in the sales ledger

- Purchases Ledger – This is also referred to as the Creditors Ledger. All the personal accounts of creditors (credit suppliers) are kept in the Purchases Ledger

- General Ledger (or Nominal Ledger) – Apart from the Cash account, the bank account and the accounts of debtors and creditors, all the remaining accounts are kept in the General Ledger. This ledger will contain accounts of assets, liabilities, expenses, incomes, sales, purchases and returns. Asset accounts are known as real accounts. Accounts for expenses, income, gains and losses are known as nominal accounts.

The above classifications of the ledger must be reflected when transactions are recorded in the ledger using the double entry principle.

EXTRACTION OF THE TRIAL BALANCE

Resulting of the operation of the double entry system it is obvious that the total amount of all the debit entries made in the books should equal the total of all the credit entries. To check if the two sides of the book balance, a Trial Balance may be drawn up periodically.

A Trial Balance is a list of the balances on the accounts in the ledger at a certain date. A trial balance is prepared to check the arithmetical accuracy of the double-entry bookkeeping. The name of each account is listed in the trial balance. The balance on each account is shown according to whether it is a debit balance or a credit balance. The trial balance will show if the total of the debit balances is equal to the total credit balances.

It is important to remember that the trial balance is not a part of the double entry system of bookkeeping as it is simply a list of balances. If the ledger accounts are balanced monthly then a trial balance may also be drawn up at the end of each month.

The trial balance should be headed with the title “Trial Balance as at ………” along with the date on which it was prepared

ASSIGNMENT

- The purchase of a typewriter for office use for N65,000 should be debited to bank account B. purchases account C. cash account D. equipment account

- Carriage inwards are incurred on goods on display B. sold C. purchased D. on return

- Returns inwards is also called carriage inwards B. carriage outwards C. purchases returns D. sales returns

- Which of the following accounts will have a credit balance? purchases account B. returns account C. returns outwards account D. drawings account

- An account is said to have a debit balance because the first entry made in it is on the debit side B. there are more entries on the debit side than on the credit side C. The total value of debit entries is more than the total value of credit entries D. There is no entry at all on the debit side