Accounting Equation And Double Entry Principle SS1 Financial Accounting Lesson Note

Download Lesson NoteTopic: Accounting Equation And Double Entry Principle

The day-to-day transactions of a business are recorded in the books of account using the double-entry system of bookkeeping. The term double entry is used because the two effects of a transaction (a giving and a receiving) are both recorded in the ledger.

Double-entry bookkeeping is the system of keeping accounts which involves the recording of the two-fold aspect of every transaction, whereby one account that receives value is debited and another account, which gives value is credited.

RULES OF DOUBLE ENTRY

- All transactions must be recorded in two accounts, one account is debited and another account is credited.

- For every debit entry in an account, there must be a corresponding credit entry in another account.

- For every credit entry in an account, there must be a corresponding debit entry in another account.

- Debit the account that receives value, and credit the account that gives value.

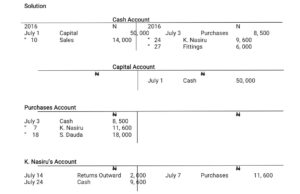

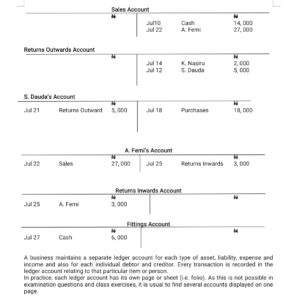

Illustration

Record the following transaction in the ledger of F. Sanusi for July 2016.

| Date | Description |

| July 1 | |

| July 3 | |

| July 7 | |

| July 10 | |

| July 14 | |

| July 18 | |

| July 21 | |

| July 22 | |

| July 24 | |

| July 25 | |

| July 27 |

WHAT ARE SOURCE DOCUMENTS?

Source documents are the instruments that are generated when businesses enter into business transactions with others.

They are the written evidence of business transactions that describe the essential facts of those transactions. They are used in preparing the books of accounts.

Every business transaction whether cash transaction or credit transaction must be supported (or evidenced) by a source document. The source documents are the original documents on which information about the transactions is recorded.

It follows therefore that accounting records can only be verified when the appropriate source documents are available to do so.

EXAMPLES OF SOURCE DOCUMENTS

- Receipt

- Invoices

- Cheque (or Cheque stub)

- Bank – paying – in – slip

- Debit note

- Credit note

- Statement of Account

- Vouchers

- Receipt: This is a written document issued by one person to another, to acknowledge that money or valuable property has been received. When goods are sold for cash, the customer is usually provided with a receipt.

- Invoice: An invoice is a business document prepared when goods are sold. It is normally sent by the seller of the goods to the buyer. When a business sells goods on credit, it will issue an invoice to the purchaser. To the seller of the goods, the copy of the invoice is a sales invoice. The same document in the hands of the buyer of the goods is called a purchase invoice.

The invoice contains the following information:

- The name and address of the supplier.

- The name, address and the account number of the customer.

- The supplier’s invoice number.

- The customer’s order number (for goods supplied in response to an order).

- The date on which the transaction is effected.

- A detailed description of the goods clearly showing the quantity bought, unit price, total price, terms of sale, terms of payment, details of trade discounts etc.

- Cheque: A cheque is a written order made by a customer to the bank to pay a stated sum of money to the person or business named on the cheque. When cheques are issued to make payment, the cheque itself or its counterfoil (or stub) would serve as the source document for the payment.

- Bank – Paying–in–Slip: This is the standard form required to be filled in duplicate or triplicate whenever cash cheques, bank drafts etc. are being paid into an account maintained with the bank.

- Debit Note: This document is issued by the seller of goods to correct an undercharge made in the account of the purchaser of the goods. For example, if the amount due from the purchaser of the goods is N18,500 and the seller has mistakenly charged (or recorded) N15,800 on the invoice, it follows that the purchaser has been undercharged by N2,700 The seller will therefore issue a debit note of N2,700 to the purchaser to correct the undercharge

- Credit Note: This document is issued by the seller of the goods to correct an overcharge made in the account of the purchaser of the goods. A credit note is therefore prepared when for several reasons the amount due from the customer (to whom goods have been sold on credit) is to be reduced.

The following are some of the reasons why the seller will issue a credit note to his customers:

- When a customer has been overcharged e.g. by a mistake on the sales invoice.

- The customer returns some of the goods he previously bought.

- Some allowance is to be made to the customer e.g. in respect of damaged goods retained by the customers.

- Statement of Account: This is the summary of the transactions between the seller and his credit customers. It is issued by the seller and sent to the customers at regular intervals (usually at the end of each month).

- Vouchers: These are source documents used for obtaining authorization for all payments whether by cash, cheque or letters of authority.

USES OF SOURCE DOCUMENT

- They are used in the preparation of accounting books of accounts.

- They provide written evidence of the business transactions that have taken place.

- They can serve as proof of ownership of property e.g. receipt.

- They are used for audit purposes.

- They are used for the reconciliation of accounts.

- They are used to obtain authorization for payments made e.g. vouchers.

- They are used to correct an overcharge or undercharge made in the customer’s account.

WHAT ARE SUBSIDIARY BOOKS?

Subsidiary books are the books of prime entry (or books of original entry) into which transactions are first recorded in detail before they are posted in totals into the Ledger.

Businesses use subsidiary books to record goods sold on credit, goods purchased on credit, sales returns, purchases returns etc. The subsidiary books are listing devices, which means that a lot of detail is removed from the ledger. It also means that bookkeeping can be divided between several people. The name book of the original (or prime) entry has arisen because all transactions should be recorded in one of these books before they are entered into the ledger.

The subsidiary books are:

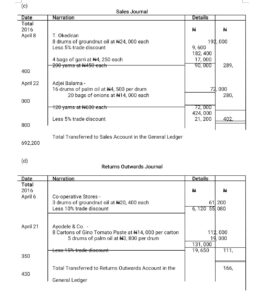

- Sales Journal

- Purchases Journal

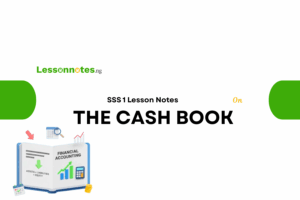

- Returns Inwards Journal

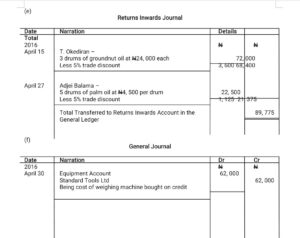

- Returns Outwards Journal

- General Journal

- Cash Book

- Petty Cash Book

USES OF THE SUBSIDIARY BOOKS

- Sales Journal or Sales Day Book: This is used to record goods that are sold on credit to the customers of the business.

- Purchases Journal or Purchases Day Book: This is used to record goods bought on credit from the suppliers

- Return Inwards Journal or Returns Inwards Day Book: This is used to record goods returned by the customers to the business.

- Returns Outwards Journal or Returns Outwards Day Book: This is used to record goods returned by the business to suppliers.

- General Journal / Principal Journal / Journal Proper or The Journal: The general Journal has multiple uses.

Uses of the General Journal

- It is used to record opening entries.

- It is used to record closing entries.

- It is used to correct errors.

- It is used to record the purchase of fixed assets on credit.

- It is used to record the sale of fixed assets on credit.

- It is used to record one-off transactions.

- It is used to effect transfers of balances between ledgers.

- It is used to demonstrate the principle of double entry.

- It is used to record transactions that cannot be conveniently passed through any other subsidiary book.

- It is used to write off bad debts.

- It is used to record the purchase of a business.

- It is used to record the issue, redemption and conversion of shares and debentures.

- Cash book: This is a subsidiary book of account that is used to record the receipt and payment of money (cash or cheque) to or by a business organization. The cash book is part of the double entry system. It functions both as a ledger and a subsidiary book of account.

- Petty Cash Book: This is the subsidiary book of account that is used to record the minor (low–value or petty) cash payments made by a business. Like the Cash Book, the Petty Cash Book is a subsidiary book and since it is part of the double entry system, it is also a ledger account.

Illustration

- Laolu, a trader undertook the following transactions in April 2016.

| Date | Description |

| Apr 1 | Started business with N25, 000 cash |

| Apr 2 | Put N18,000 of the cash into a bank account |

| Apr 5 | Purchased from Co-operative Stores –

15 drums of groundnut oil at N20, 400 each 12 bags of garri at N3,500 each. Invoice subject to 10% trade discount |

| Apr 8 | Sold to T. Okediran –

8 drums of groundnut oil at N24,000 each. Less 5% trade discount, 4 bags of garri at N4, 250 each 200 yams at N450 each |

| Apr 9 | Returned to Co-operative Stores –

3 drums of groundnut oil were bought on 5th April 2016. |

| Apr 10 | Bought from Oyesile & Sons –

650 yams at N380 each, 32 bags of onions at N12, 500 per bag, 60 bags of Dangote 50kg iodized salt at N3, 200 per bag. |

| Apr 12 | Paid Co-operative Stores N65, 700 cheque on account |

| Apr 15 | T. Okediran returned 3 drums of groundnut oil bought on the 8th of April, 2016. |

| Apr 18 | Sold 320 yams at N550 each for cash |

| Apr 19 | Bought from Ayodele & Co –

45 bags of onions at N12,000 each, 50 cartons of Gino Tomato Paste at N14, 000 per carton, 20 drums of palm oil at N3,800 per drum, Invoice subject to 15% trade discount. |

| Apr 21 | Returned to Ayodele & Co –

8 cartons of Gino Tomato Paste and 5 drums of palm oil were bought on the 19th of April, 2016. |

| Apr 22 | Sold to Adjei Balama –

16 drums of palm oil at N4,500 per drum, 20 bags of onions at N14,000 each, 120 yams at N600 each, Invoice subject to 5% trade discount |

| Apr 25 | Paid sundry expenses N8, 400 by cheque |

| Apr 26 | Paid rent of shop N15,000 cash |

| Apr 27 | Adjei Balama returned 5 drums of palm oil to us because they were damaged |

| Apr 29 | T. Okediran paid by cheque for all the sales made to him. |

| Apr 30 | Bought weighing machine from Standard Tools Ltd on credit N62,000 |

You are required to record the above transactions in the appropriate books of original entry.