Theory Of Income Determination SS2 Economics Lesson Note

Download Lesson NoteTopic: Theory Of Income Determination

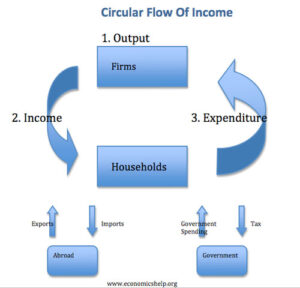

CIRCULAR FLOW OF INCOME

Circular flow of income shows the independence or relationship between households and business enterprises.

Commodity and money flow between households and firms. It shows the flow of payments from the business sector to households in exchange for labour and other productive services and the return flow of payments from households to the business sector in exchange for goods and services.

The household or the personal sector offers its labour services to the business sector or firms in the production of goods and services. The household is rewarded in the form of wages, interest and rent which it spends on the consumption of goods and services produced in the economy.

FACTORS THAT BRING ABOUT CHANGES IN THE CIRCULAR FLOW OF INCOME

- Withdrawal: This part of all the income that is not allowed to pass through the normal channel of circular flow of income.

- Injection: This forms an increase in the income of households, and producers outside their normal processes of selling productive resources and manufactured goods.

- Savings: These are part of income which are not consumed immediately and they reduce households’ and producers expenditures.

- Investment: This reduces and creates additional income either immediately or in future.

- Gifts and grants: They may come from governments to households and firms and help increase their incomes.

- Taxes: They reduce the expenditures of households and firms on goods and factor services.

- Imports: They involve expenditure on foreign-made goods and services and constitute withdrawals from the circular flow of income.

- Export: They Provide money from other countries and act as an injection into the domestic circular flow of income.

CONCEPTS OF SAVINGS, INVESTMENT AND CONSUMPTION

SAVINGS

Savings are made up of disposable income which is not spent on consumer goods and services. Saving involves forgoing some present consumption.

Individuals save for the following reasons:

- To raise capital

- For unforeseen contingencies

- For speculation

- To acquire assets

- For future purposes

- To raise social status

Factors That Affect Savings

- The size of income

- The rate of interest

- Cultural attitude

- Government policies

- Availability of financial institutions.

INVESTMENTS

Investment may be defined as expenditure on physical assets which are not for immediate consumption but for the production of consumer and capital goods and services.

Types of Investment:

- Individual investment: This may be on building, motor vehicles and other assets the individual hopes may increase his income and standard of living.

- Investment by firms: This can be on buildings, machines, furniture, raw materials, semi-finished and finished goods.

- Government investment in social capital; These are in the areas of roads, electricity, pipe borne water, hospitals, and schools.

Purpose: to improve the living conditions of the citizens.

- Government investment in public corporations: To render essential services create more employment opportunities among others, are sure of the reasons why the government invests.

Factors That Determine Investment

- The amount of income earned.

- Savings

- Profit

- The amount paid as tax

- The rate of interest

- Expectation

- Business atmosphere

- Political factor

CONSUMPTION

Consumption is the sum of current expenditure on goods and services by individuals, firms and government. It also means part of the income is not saved or invested. The level of consumption of an individual depends largely on his level of current income.

Factors that determine the level of consumption include:

- The level of income

- Savings

- Expectation of price changes

- The rate of taxes paid

- The influence of other households

- Assets owned

- The rate of interest received

- Business profit

THE RELATIONSHIP BETWEEN INCOME, CONSUMPTION, SAVINGS AND INVESTMENT

Income, consumption and savings are related. The amount of income earned (household) determines to a large extent the level of consumption of an individual as well as the amount which can be saved. This is represented by the formula. Y = C+S, where Y = Income, C = Consumption expenditure and S = Savings

Also, income, consumption and investment are related. The amount of income earned (business sector) determines to a large extent the level of spending on the running overhead cost (consumption) as well as the amount spent on further investment. This is represented by the formula: Y = C + I , where Y = Income , C = Consumption expenditure , I = Investment Expenditures

In forming an equation with household income and the business sector income, we have:

C + S = C + I

S = I

Consumption influences the level of national income. If people consume more, it encourages further production. The economy is at equilibrium when aggregate saving equals aggregate investment and full employment is achieved at this level. We save to accumulate capital for investment and many other personal reasons. There will be no investment without saving. Investment, in turn, creates employment and income for people. Without income, we shall have nothing to save and nothing to spend on the consumption of goods and services.

ASSIGNMENT

- The part of income that is not spent is known as ____ (a) multiplier (b) saving (c) expenditure (d) depreciation

- All these factors tend to reduce the amount of funds in the circular flow of income except………………. (a) savings (b) grants (c) imports (d) taxes

- The real capital investment of a country is a reflection of its…………… (a) total debts (b) total goods (c) total income (d) total reserve

- An expenditure on physical assets which are not for immediate consumption is known as…………… (a) a consumption (b) an investment (c) a liability (d) a saving

- ………………is the major determinant in the concepts of saving, investment and consumption. (a) cost of living (b) multiplier (c) standard of living (d) income.