Balance Sheet SS1 Financial Accounting Lesson Note

Download Lesson NoteTopic: Balance Sheet

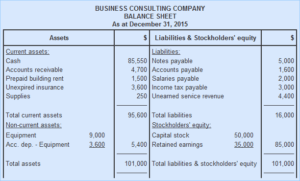

The Balance Sheet is a statement of the financial position of a business on a certain date. It shows the assets, liabilities and capital of the business in a well-arranged form.

Unlike a Trading, Profit and Loss Account, a Balance Sheet is not part of the double entry system. After the nominal account balances have been transferred to the Trading and Profit and Loss Account, the only balances left in the ledger are those for assets and liabilities. The Balance Sheet is a list of these balances.

Although a Balance Sheet is not an account, The Trading and Profit And Loss Account and the Balance Sheet are known collectively as the final accounts of a business.

LAYOUT OF THE BALANCE SHEET

The Balance Sheet is prepared by listing and grouping the assets and liabilities of the business under appropriate headings as below:

- Fixed Assets

- Current Assets

- Current Liabilities

- Long-term Liabilities

- Capital

NB:

i. A Balance Sheet is a ‘position’ statement showing the position of a business at a particular date. It is not a ‘period’ statement like a Trading and Profit and Loss Account.

ii. The fixed assets are listed in order of permanence. Eg:

a) Land and Buildings

b) Plant and Machinery

c) Furniture and Fittings

d) Equipment/ Tools

e) Motor Vehicles

iii. The current assets are listed in the reverse order of realisability i.e. the ease at which they can be converted to cash. The order is:

a) Stock

b) Debtors

c) Bank

d) Cash

At the end of the year, the balances on the Profit and Loss Account and Drawings Account are transferred to the Capital Account (by Journal entries). However, the details are still shown in the Balance Sheet to show how the closing capital is arrived at.

DEFINITION OF BALANCE SHEET ITEMS

- Assets: These are the resources, properties or possessions owned by the business as well as what other people or firms owe the business. Examples are Land and Buildings, Motor Vehicles, Furniture, Equipment, Machinery, Tools, Stock, Cash at hand, Cash at Bank, Debtors etc. Assets can be divided into fixed assets and current assets.

a) Fixed Assets are long-lasting assets which are acquired for use rather than for resale. Fixed assets help the business to earn revenue. Examples are Land and Buildings, Plants, Machinery, Motor Vehicles, Furniture, Fittings, Tools, Equipment etc.

b) Current Assets are assets which are usually held by the business for a short period. They are usually converted from one form to another in the course of business. Current assets are either in the form of cash or can be turned into cash relatively easily. Examples are Stock (Inventory), Trade Debtors (or Sundry Debtors), Bank and Cash.

- Liabilities: These are obligations arising from past transactions. It is a claim by outsiders on the assets of the business. Liabilities represent what the business owes other people or firms. Liabilities can be classified as current liabilities and long-term liabilities.

Current Liabilities are short-term liabilities. They are the amounts owed by the business which are due for settlement (repayment) within the next twelve months (i.e. one year) of the date of the Balance Sheet. Examples are Trade Creditors (or Sundry Creditors), Bank Overdrafts etc.

Long – Long-term liabilities are amounts owed by the business which are not due for repayment within the next twelve months (i.e. one year) of the date of the Balance Sheet. Examples are Long-term loans, Mortgages, Debentures etc.

The Balance Sheet can be prepared in two ways – horizontal format and vertical format. The Balance Sheet earlier prepared for Ade Molayo was prepared in the horizontal format.

NB: The main advantage a vertical Balance Sheet has over a horizontal Balance Sheet is that it shows the figure for the net current assets. This is also known as the working capital.